Each

basin has certain characteristics that make the basin economically viable and

dynamic in the market place. Assuming the basin has large reserves, the most

important factor in making a basin productive is the costs of production. These

production costs are incurred by a producer to drill, frack, complete, gather,

transport, and deliver production to the market. Ultimately, the overall

production costs, minus the final sales price of a barrel of crude, will

determine the gross margins for any given producer, and establish the Internal

Rate of Return (IRR) for that producer. Also, those production costs will

establish what any given producer’s “break-even” levels will be.

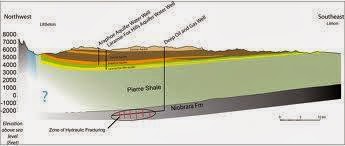

Based

on current information published in the Oil & Gas Journal of the largest 32

plays in the United States, the Niobrara-Wattenberg ranks 3rd, with an average

IRR of 53%. The Niobrara play is a close 3rd to the Eagle Ford play (54%) in

Texas, and behind the Marcellus Shale Play (56%) in Pennsylvania, which is

currently the highest average IRR play in the US. The Bakken play is currently

running in 13th place with an IRR average of 31%.

However,

what’s really interesting about all these basins is the average “break-even”

level, and how that factors into the rankings. The “break-even” level is the

price point of a barrel of oil, for which the production costs and the final

sales barrel price are equal to West Texas Intermediate Crude (WTI). Today, WTI

is trading at $106.79/bbl.

According

to data collected by Tudor Pickering & Holt, an independent industry

research firm; the Niobrara has the lowest average “break-even” level of all

the 32 active large plays in the US. The Niobrara has an average “break-even”

level of $38.00/bbl for WTI crude. The Bakken Shale play has an average

“break-even” level of $65.00/bbl for WTI crude. In comparing how the

“break-even” values of the Niobrara and the Bakken rank in the top 32 large

plays; they rank 1st and 17th respectively. Now compare those average

“break-even” levels with where WTI oil is currently trading and you’ll get an

idea of how much momentum each play has in economic terms.

Knowing

these numbers and continuing to watch how they evolve is very important in

judging the project opportunities for these basins. Production basins like the

Niobrara and the Bakken can be very dynamic, and right now both basins are very

well positioned to continue to grow and provide great opportunities.

No comments:

Post a Comment